If you’re thinking about selling in 2026, one of the first questions you’ll ask is:

“How much is my property actually worth?”

Online estimates can be helpful, but they often miss the full picture. Property value isn’t just a number — it’s influenced by the market, the condition of the home, and how buyers are actually behaving right now.

This guide breaks down how property value is really calculated in 2026, without confusing formulas or industry jargon.

1. Start With Recent Comparable Sales (Comps)

The most important factor in determining value is what similar properties nearby have sold for recently.

When looking at comps, focus on:

Homes sold within the last 3–6 months

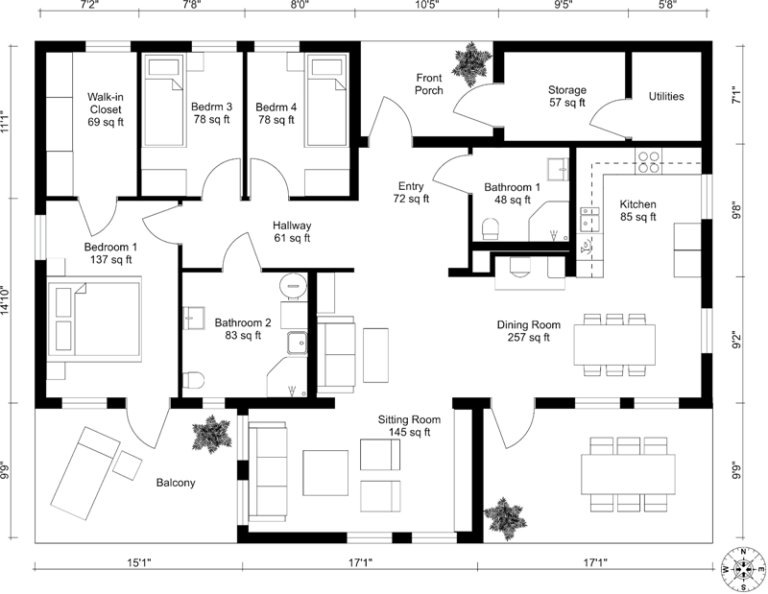

Similar size and layout

Similar lot size

Same general area

2. Adjust for Property Size and Layout

Square footage still matters in 2026, but layout matters almost just as much.

Buyers pay attention to:

Total usable space

Bedroom and bathroom count

Flow and functionality

A well-designed smaller home can outperform a larger but poorly laid-out one.

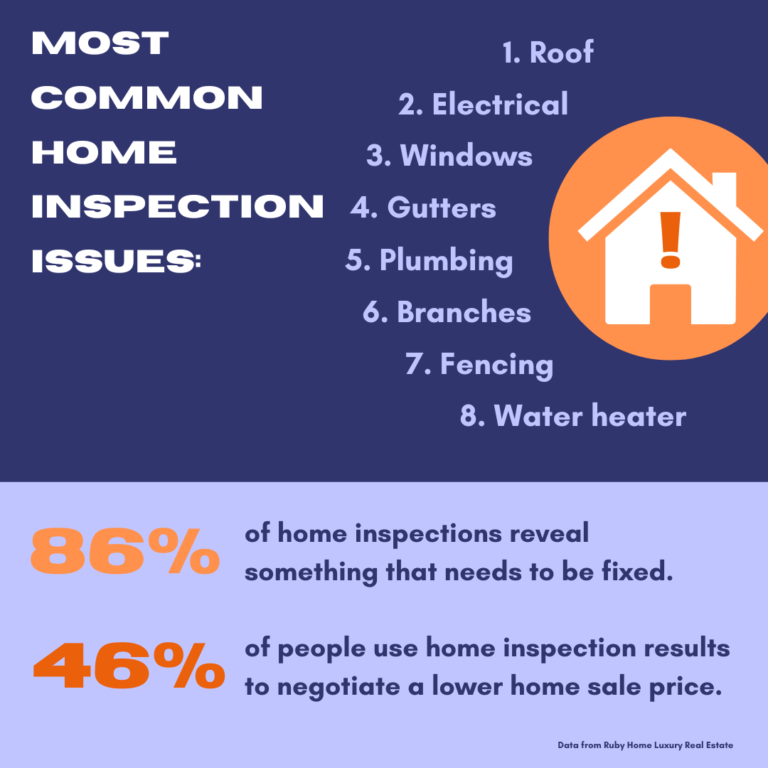

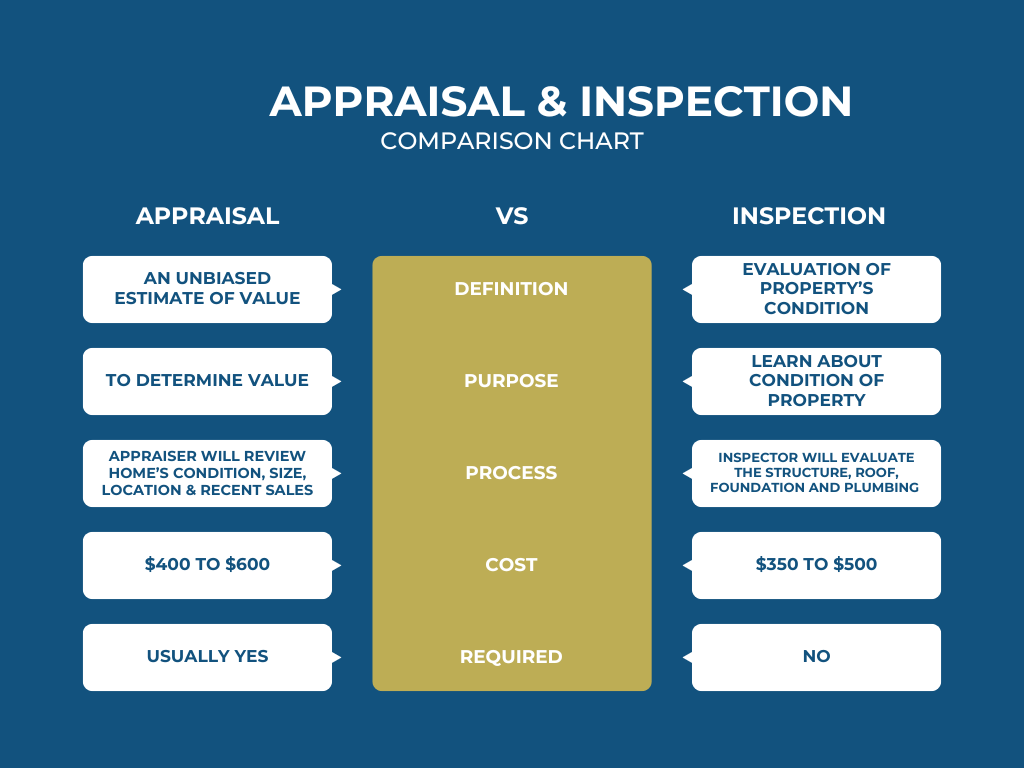

3. Factor in the Condition of the Property

Condition has a direct impact on value. In 2026, buyers are careful and price repairs into their offers.

Things buyers notice immediately:

Roof, plumbing, electrical

Foundation or structural issues

Outdated kitchens or bathrooms

Homes needing work usually sell for less — unless priced correctly.

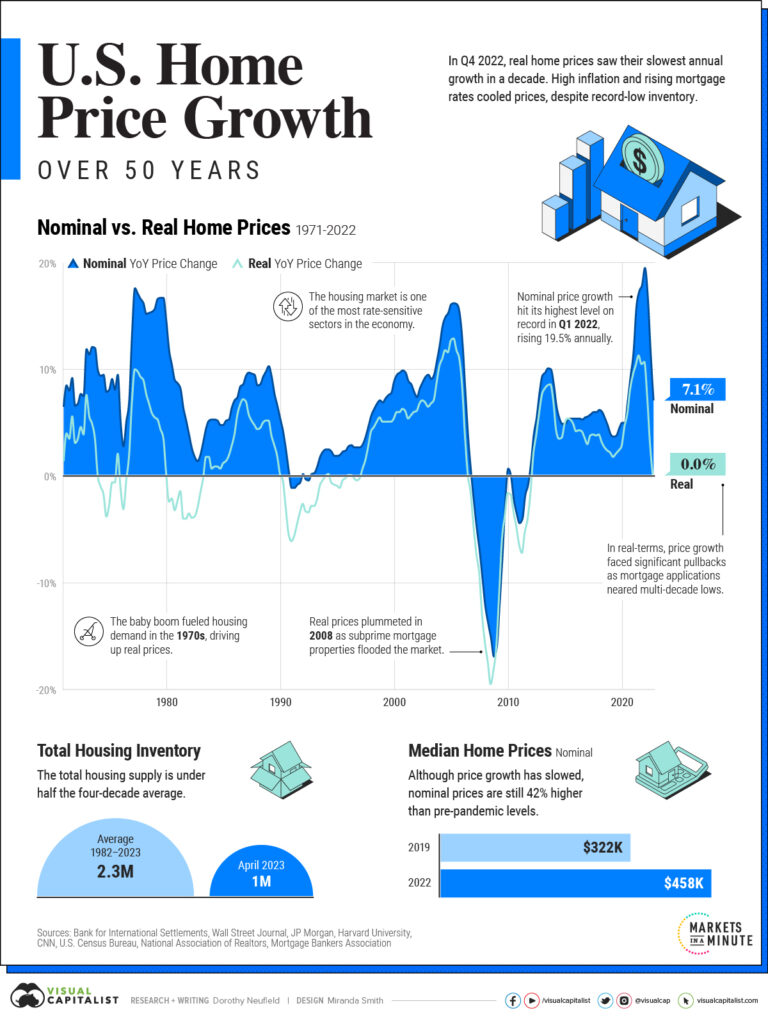

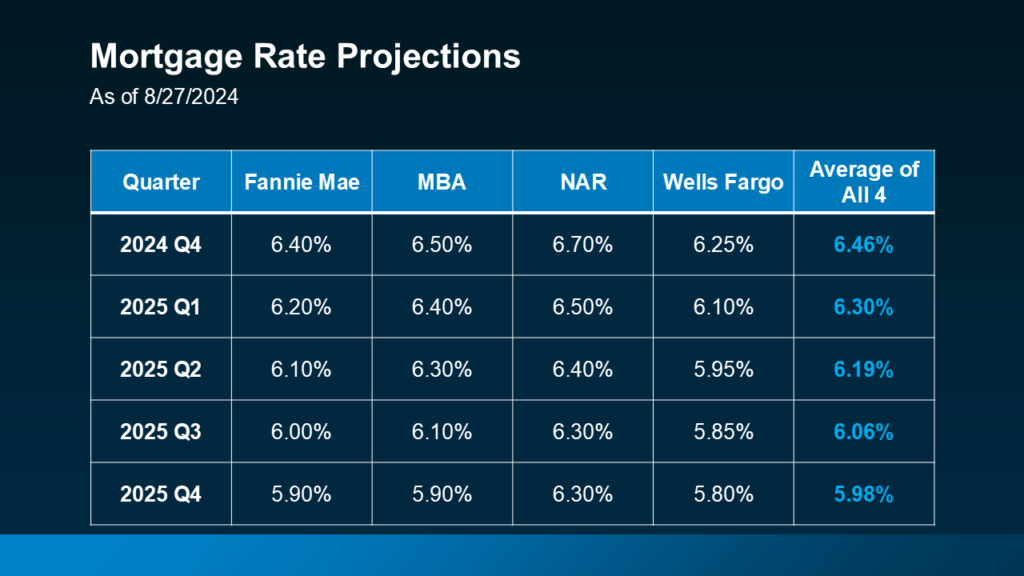

4. Understand How the 2026 Market Affects Value

Market conditions play a huge role in pricing.

Key factors include:

Interest rates

Buyer demand

Inventory levels

In higher-rate environments, buyers become more selective, which directly affects offers.

5. Location Still Matters (But Differently Now)

Location isn’t just about the zip code anymore.

Buyers also consider:

Neighborhood stability

Nearby schools, shopping, and transit

Long-term growth potential

Two homes close together can still have very different values.

6. Look at Rental Value (Even If You’re Selling)

Many buyers in 2026 are investors or future landlords.

Rental value impacts:

Demand for the property

Willingness to pay

Long-term value

Even homeowners should understand how their property performs as a rental.

7. Online Estimates: Helpful, But Not Perfect

Automated estimates can be a starting point, but they often:

Ignore property condition

Miss recent market changes

Overestimate or underestimate value

Use them as a reference — not a final number.

8. What Buyers Actually Pay vs. “Market Value”

There’s a difference between estimated value and what buyers will actually offer.

Buyers factor in:

Risk

Repair costs

Time and financing

That’s why offers can vary widely.

9. The Fastest Way to Get an Accurate Property Value

The most accurate value comes from:

Recent sales data

Market conditions

Property condition

This can come from a professional appraisal or an experienced buyer who understands today’s market.

Want a Real, No-Nonsense Property Value?

At Atom Property Group, we provide honest, no-obligation property evaluations based on real market data — not automated guesses.

-

No fees

-

No repairs

-

No pressure